How to Choose the Best Budgeting App

If you’re having trouble keeping track of your spending, a budgeting app can be a great tool. It will help you create a customized budget, and track your spending over time. It will also alert you if certain bills are rising or spending habits are changing. The app will also give you the chance to share your budget with others.

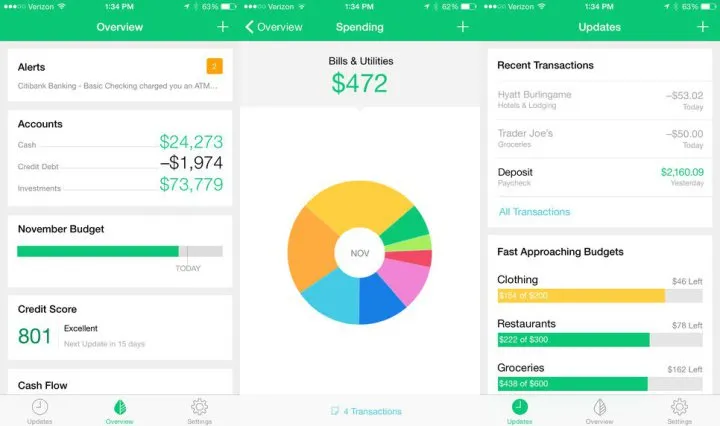

Mint was founded in 2006 and has been a popular budgeting tool for consumers since 2009. The app was acquired by Intuit, a financial management solutions company, in 2009. It has over 20 million users and continues to grow. It is free and has an extensive feature set. It can sync with bank accounts and track monthly bills and subscriptions.

Many budgeting apps have additional features, such as investment portfolios and the ability to open a joint bank account. Some also offer tools to monitor your credit score. This is an essential part of taking control of your finances. Several budgeting apps prompt you to link your bank accounts so that they can track your spending and provide automatic bill-paying reminders.

Simplifi is an easy-to-use app that integrates with more than 14,000 financial institutions. It helps you identify unnecessary expenses, and also helps you set custom limits for different categories. It also helps you set up savings goals. All of these features will make it easy for you to stay on track with your finances.

When looking for the best budgeting app, you should decide what features are most important to you. You should consider whether you want a budget that is flexible or strict, or automatic. You should also decide whether you want an app that syncs with your bank account or requires you to manually enter your expenses. It is also important to decide which device to use for the service.

Another consideration is security. If you have a credit card or bank account with many companies, you may want to opt for a budgeting app that does not sync with your bank account. Many of these budgeting apps don’t store your bank credentials on their servers, so they may not be secure for you. However, some apps do offer two-factor authentication. You can opt for this under your account settings. If you are concerned about your account security, you should consider using a password manager.

One of the best budgeting apps available is Mint. This app is easy to use and has received great reviews from users. It helps you categorize your spending and create a budget based on your current spending. Mint can also check your credit score and track your bill payments. It is a popular app with over 25 million users.

Mint uses bank-grade encryption to protect your data and keeps your information secure. It will delete your information if you close your account. However, it will keep your information for up to three years if you decide to uninstall it. Another budgeting app is Zeta. This budgeting app is designed specifically for couples. It allows couples to manage their finances together and can even sync different accounts.